Document Type : Original Research Article

Authors

KIIT School of Management Campus-7, KIIT Bhubaneswar 751024 Odisha, India

Abstract

Purpose: This article made an effort to evaluate the effect of the pandemic on the healthcare ecosystem. It aimed to analyse the performance of the pharmaceutical industry, hospitals, and firms engaged in diagnostic and laboratory activities.

Design and Methodology: The performance of the healthcare firms has been assessed by studying the stock price movement of these firms using event study methodology. The market model and the Fama & French three-factor model have been used to estimate the normal or expected return. The abnormal return which is computed by deducting the expected return from the actual returns across the event period helped the researcher evaluate the performance of the healthcare industry during the pandemic. The daily returns data from 1st June 2019 to 13th April 2020 of 22 firms listed on the Indian stock exchange has been used for the study. The standard t-test (parametric) and the Kollari & Pynonnen generalized rank (GRANK) test (non-parametric) have been used for testing hypothesis.

Results: Results showed that the cumulative average abnormal return (CAAR) for all 22 firms grouped together was positive and statistically significant. The CAAR for Nifty Pharma and BSE Healthcare was also positive and statistically significant. The result confirms that the pandemic had a positive impact on the Indian healthcare industry. This article helped researchers and investors appraise the performance of healthcare industry during pandemic.

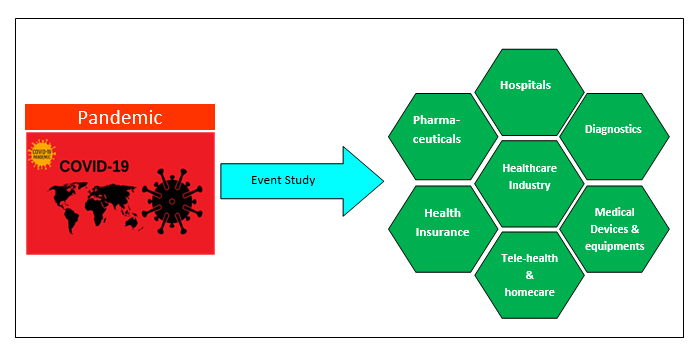

Graphical Abstract

Keywords

- Pandemic (COVID-19)

- healthcare industry

- abnormal return

- event study

- expected return

- cumulative average abnormal return (CAAR)

- index return

Main Subjects

Introduction

COVID-19 has been the most dreadful epidemic in the 21st century. It had a pernicious impact on human health, economics, and social activities [1]. Since the physical health of humans was in danger, it was bound to have an adverse impact on almost all economic activity [2]. Many industries witnessed restricted operations, and many industries, like airlines and hotels, were completely closed for months together. Modern economic activity is immensely interconnected and interdependent. Though all business segments were impacted by the pandemic, the extent of the impact on a particular segment of business was dependent upon its independence of operation, substitution of man by machine, adaptability of digital channels, and its utility for society at large. Healthcare remained at the top of the list with respect to its utility for mankind. The pandemic was a formidable challenge for healthcare practitioners throughout the world. They had the tough task of treating the affected patients and preventing the disease from spreading its tentacles. The industry was engaged in inventing an effective drug and a vaccine. The administration was busy controlling the disease and ameliorating the health care infrastructure to take care of the growing number of infected people. Demand for prescription medicines, vaccines, and medical devices was growing manifold [3]. There was a shortage of antibiotics and vitamins in the early stages of the pandemic. It took around 2-3 months to increase production capacity and boost distribution to bridge the demand-supply gap. There was a panic reaction among most of the citizens, as most of them were not prepared for this event. There was an attempt by all, especially the vulnerable sections like senior citizens and children, to jack up immunity. However, the supply chain was not able to operate at its full capacity, causing disruptions to production, supply, and distribution [4]. Online drug sellers were blooming to fill the gap. It was both a difficult time and an opportunity for the health care ecosystem.

As we know, the stock market is a barometer of the performance of an individual firm, a sector, and the whole industry. This article tried to assess the effect of the pandemic on the healthcare industry by measuring the performance of the stocks of the firms that are part of the healthcare ecosystem. The performance of the healthcare industry in terms of stock prices was assumed to be positive, as the health care ecosystem was expected to benefit from the event. The temporary gap in supply and demand of drugs used to treat COVID-19 and the consequential health hazard were expected to enhance the focus on the health care industry.

Literature Review

Healthcare System

The healthcare industry encompasses hospitals, pharmaceuticals, medical devices and equipment, diagnostics, medical insurance, and home health care, including telemedicine, and medical tourism. An effective and efficient healthcare system is essential for the overall development of the country. The World Health Organization (WHO) has identified the fundamental components of a healthcare system as “the delivery of effective, safe, and quality interventions; an adequately trained and distributed workforce; a health information system that analyses and disseminates reliable data; safe and efficacious medical technologies that are cost-effective and accessible; a financing system that raises adequate funds to ensure coverage of the population from any financial catastrophe; and a good governance system to oversee the administration of these building blocks.” The quality of healthcare is evaluated on the basis of the accessibility and affordability of health care facilities. As per the report published by verified market research, the value of world healthcare industry in dollar terms is US$ 10.30 trillion in 2021 and is estimated to become US$ 21.06 trillion by 2030 [5].

Increasing access to health care facilities and containing the cost of health care facilities are the two important responsibilities of policymakers. Expenditure on healthcare as a percentage of GDP is not a perfect indicator of a good health care system because there are countries that spend the highest amount on healthcare, but they do not appear at the top of the list of the best healthcare provider countries. For example, the US spends the highest percentage (16.6%) of its GDP on healthcare, followed by Germany, France, and Japan. But, it was found to appear last in the list prepared by the Commonwealth Institute while making a study of the healthcare systems of 11 high-income countries. The study used parameters like accessibility, process of care, administrative efficiency, equality of treatment, and the quality of healthcare outcomes. Norway, the Netherlands, and Australia were found to top the list with the best facilities [6]. As per the Legatum Institute report, Singapore has the best healthcare facilities, and India has 112 ranking [7].

India has become a bright spot on the global healthcare map as it continues to develop state-of-the-art medical infrastructure and focuses more on research, innovation, and digitisation of health care services. This sector is a major contributor to Indian economy in terms of revenue and employment. The government’s spending on health care was 2.1% of GDP in FY 2023 and is expected to reach 2.5% of GDP by 2025. The growth of the Indian health care ecosystem could be attributed to an increase in the elderly population, higher disposable income, enhanced insurance coverage, better health awareness, an increase in stress levels, growth of medical tourism, and an increase in lifestyle diseases. The hospital segment is the highest contributor to the Indian healthcare market, with 70% of the market share, followed by pharmaceuticals at 20%, medical technology and others at 10%.

The value of Indian pharmaceuticals market is currently US$50 billion and is estimated to become US$150 billion in a decade. In terms of volume, it is the third-largest pharmaceuticals market in the world and the largest supplier of generic drugs. Therefore, it is popularly called the “pharmacy of the world”. The cost of production of drugs in India is 33 percent cheaper than that in the US, which offers a competitive edge to Indian drug manufacturers. However, Indian drug manufacturers were mostly manufacturing drugs with pre-existing formulations at lower costs. There was a lack of focus on innovation and the development of new formulations. In order to make India self-reliant on drug manufacturing and to incentivise innovations, the Government of India (GoI) included the sector in its “Aatmanirbhar Bharat” program through the production-linked incentive (PLI) scheme. Under the scheme, GoI disbursed the first tranche of investment of US$ 1.83 billion in March 2020, followed by an investment of US$ 2 billion in March 2021 to step up production of APIs (active pharmaceutical ingredients).

India has justified its name “pharmacy of the world” by supplying the COVID-19 vaccine to more than 150 countries since the outbreak of the pandemic. It is the largest manufacturer of vaccines, producing nearly 60% of all vaccines. Its pharmaceutical exports grew by 18% (US$ 4 billion) from FY 20 to FY 21; the highest ever export growth, on account of the high global demand spurred by the pandemic. As the global supply chain system was severely impacted by the pandemic, the pharmaceutical export promotion council of India (Pharmexcil) conducted a study to identify the critical APIs and major raw materials that it was importing mainly from China, which helped the Department of Pharmaceuticals develop the PLI scheme to encourage the manufacturing of those products to reduce import dependence. The Indian healthcare ecosystem is based on three pillars, i.e., accessibility, affordability, and quality.

Since pandemics have a collateral impact on health and aggravate pathological symptoms and chronic ailments in the majority of the population, the focus has been on nutraceuticals to ameliorate overall immunity and resistance to illness. The pharmaceutical industry is shifting its focus from illness to wellness. With the rise in medical infrastructure, the medical instrument market in India is growing at 2.5 times the rate of the global average and is the fastest among all emerging markets. The medical instrument market in India is estimated to be US$11 billion this year and is forecast to reach US$50 billion by the end of the decade.

The pandemic

The first official case of Corona virus disease (COVID-19) was detected in Wuhan, Hubei Province, China, on 31st December 2019 [8]. After a month, WHO declared the fast-spreading COVID-19 a public health emergency of international concern (PHEIC) on 30th January 2020. The number of infectious people reached 1,00,000 on 7th March, 2020 and after four days the WHO declared the COVID-19 pandemic on 11th March, 2020. China implemented severe restrictive measures to contain the virus, and as a result, the spread of the infection decreased substantially. But in Europe, the infection was increasing rapidly. Italy was worst hit by the virus, and the death toll rose to 250 per day on 13th March 2020. Seeing the high mortality rate and the catastrophic impact of the virus, the WHO reported Europe as the epicentre of the pandemic on 14th March,2020. A state of emergency was declared by theUS on the same day, i.e. 14th March 2020. Restriction on travel, lockdowns, closure of offices and business establishments, hand sanitisation, quarantine, contact tracing, and social distancing were implemented across the globe to control the virus spread. Within a short period of 25 days, the total number of global infections reached 1 million on 2nd April 2020. The figure was alarming enough to send a wake-up call to explore permanent prevention in the form of a vaccine. The WHO circulated guidelines for wearing masks on 6th April as evidence of airborne infections was found in many parts of the globe. Though the infection declined in the summer, a fresh variant of the virus was found in August, 2020. The number of cases surged with the emergence of the new variant, and the total number of deaths reached 1 million by 29th September, 2020. The vaccine preparation through multiple phases of trials reached the final stage and got the approval of the WHO for emergency use on 31st December, 2020. The commercial production of vaccines marked the beginning of the end of the pandemic. Since then, the vaccine has been administered on a war footing to increase the safety net. On 5th May, 2023, WHO formally declared the end of the PHEIC. Many countries have already started considering COVID-19 as an endemic disease, much before that. The statistics show that as of 13th April 2020, there have been 1773084 COVID-19 cases and 111652 confirmed deaths, which make it one of the deadliest epidemics and pandemics.

There was huge pressure on hospital infrastructure owing to the sudden rise in COVID-19 patients and strict adherence to isolation norms. This led to non-COVID patients resorting to home care facilities. Many COVID patients with mild symptoms were also advised to stay home and seek tele-health advice. This trend is expected to continue in the post- COVID era where patients are adopting digital modes of health care. With the adoption of Artificial intelligence (AI), the health care sector is transforming. COVID-19 created unexpected rise in demand for antibiotics for treating infections of the lungs, sedatives, and painkillers resulting in an increase in demand to the tune of 100% to 700% since the beginning of January,2020. The Food and drug administration (FDA) in United States declared a shortage of pharmacotherapies, azithromycin, dopamine, fentanyl, hydroxychloroquine (HQC), dobutamine, chloroquine (QC), heparin, propofol dexmedetomidine, and midazolam.

The rising demand of antibiotics, prescription drugs, vaccines, ventilators, oximeters, and other medical equipment was aggravated by supply-side constraints due to disruptions in the supply chain, lockdowns, panic buying, and stocking. As China and India, the world’s largest producers of key starting materials (KSMs), active pharmaceutical ingredients (APIs), and also finished pharmaceuticals were impacted by the pandemic, the global supply was curtailed. The long- term impact includes delay in drug approval, efforts to become self-reliant in pharmaceutical production supply chain, and adoption of digital health care facilities [3].

Global social unrest and economic hardship brought about by the pandemic resulted in a severe recession. The widespread supply chain disruptions caused a food shortage. Apart from its terrible impact on health, it was too dreadfully contagious to engulf the whole human population in a very short time. It was potentially devastating for humans in economics, social, and physical terms.

Stock return and event studies

Event study is a statistical method to evaluate how a significant event or events affect the performance of firm by studying the share price movement of the firm. The early researchers who used event study were James Dolley, John H. Myers and Archie Bakay and C. Austin Barker who made an attempt to assess how a stock split would affect stock prices, and then Ball and Brown tried to assess the effect of income numbers on stock prices by collecting the income numbers of 261 firms for a period of 1957 to 1965 [9]. It was discovered that, though annual income data was one of the most helpful sources of information for investors, but by the time the annual income figure was out, periodic information regarding the firm was already inbuilt into its stock price. The study's findings support the efficient market theory, which that all available information is factored in stock price.Another path-breaking study was done by Fama et al. to understand how quickly the market absorbs new information [10].

The study was conducted collecting information regarding 940 stock splits from 1926 to 1960. The results demonstrated the efficiency of the market, confirming the fact that new information was promptly adjusted to the stock price. After 1970, researchers tried to resolve the statistical and econometric issues in event studies to make it statistically valid [11-13].

Event study methodology (ESM) became the most popular method for determining the behaviour of stock prices in response to an event or series of events [14]. Since then, event studies have been used for two major purposes: the first one is to test the efficiency of the market, and the second one is to assess the extent of movement in the stock price of firm. The effect of an event on the value of a firm is immediately observed on the stock prices of the firm, in contrast to productivity-related impacts which take a long time to get reflected [15]. The ESM was predominantly utilized to assess the effects of company-specific events like mergers, acquisitions, investments, new products, innovations, etc. Recently, this has been extended to include macro-events like COVID-19.

ESM is able to analyse how a particular event affects changes in stock prices [11]. It helps in assessment of magnitude of impact of firm-specific events like the issue of bonus shares, stock splits, investments, formation of joint ventures with strategic partners, dividend declarations, capital infusions etc. which are internal to the firm, and also macro-events like major policy changes, regulatory announcements, interest rate hikes etc. which are external to the firm. It attempts to evaluate the effect of an event more objectively as it deals with the data of the stock market, which is not controlled by managers, leaving almost no scope for manipulation of the performance of the firm. Stock performance is the perfect criterion for measuring the value of a firm, as it reflects all publicly available information [16]. The main aim of ESM is to evaluate the quantum of extra or abnormal returns gained by investors, consequent to the announcement of any unanticipated event impacting a particular firm or a business segment [17].

Impact of the pandemic on stock return of healthcare industry

The Pandemic had significant negative impact on the pharmaceutical stocks in India, and the performance of pharmaceutical stocks was in line with that of the Nifty S&P BSE Sensex, CNX Nifty, and Nifty pharma index [18-20]. Similar results were observed in a study of the stock returns of eight countries: France, Spain, China, Germany, Italy, the USA, Japan, and South Korea [21] .

A few other studies discovered that the stocks of pharmaceutical industries performed better during the pandemic and specifically during the lockdown period [22-25]. In a study of the effect of different events related to pandemic (the WHO declaration, travel ban, lockdown, and stimulus package on stock markets of 25 countries it was found that the initial reaction of markets was very high and gradually it settled down as more information was made available [24]. Along with pharmaceutical stocks the diagnostic stocks also witnessed a upward trend. The stock price of two largest diagnostic firms Dr. Lal Pathlabs and Thyrocare increased 20% and 14%, respectively. Since March 23, 2020, the two main pharmaceutical stock indices, S&P BSE Healthcare and Nifty Pharma, have risen by roughly 36% and 42%, respectively. It was noticed that almost all stocks have yielded negative return during 1st lockdown whereas during the second stage all NIFTY Pharma stocks have shown positive return and continued to generate higher return to the tune of average 77% till September 2021. Overall NIFTY Pharma has outperformed NIFTY with an average of 36% higher return during pandemic. A comparative analysis of major NIFTY sectoral indices revealed that NIFTY Pharma recorded highest gain of 75%. Similarly though the S&P BSE Sensex declined by 48% the healthcare sector registered 18% growth during pandemic [26].

A comparative analysis of seven largest exchange traded funds (ETFs) by market cap of each of financial, pharmaceutical, and healthcare sectors revealed that the average return of the ETFs of health care sector showed the best performance and with respect to volatility the pharmaceutical sector has the least volatility [27].

Research gap

On analysis of the previous research works of scholars, one clearly visible gap was identified. That is, the scope of the study has not been extended to the whole health care industry, of which the pharmaceutical industry is a part. As has been witnessed, the COVID-19 impacted hospitals, diagnostics, medical equipment and pharmaceuticals. Therefore, it is essential to study the impact on all these segments, which constitute the healthcare industry. An econometric analysis was suggested to discover the relationship between the pandemic and financial markets [24]. The requirement of widening the scope of the research by adding more pharmaceutical companies and including other sectors of the healthcare industry was acknowledged [18].

While numerous studies have explored the performance of pharmaceutical industry during pandemic, none have specifically addressed its effects on the entire healthcare sector. Studying its impact on only pharmaceutical companies is a narrow approach and will only explain half of the story. It excludes other constituents of the health care ecosystem like hospitals and diagnostic sectors. The immediate impact was on the diagnostic segment, as there were not sufficient test kits available to confirm the infection. Testing was very important, as early detection would save lives as drug administration could be faster. Then there was also huge pressure on hospitals and medical equipment like oxygen concentrators, oxymeters, etc. Therefore, a comprehensive study of the healthcare industry will give us the right picture.

Based on results of past studies, we formulated the following hypothesis:

H0. The mean abnormal return is 0 during the event period.

Materials and methods

Context

The healthcare industry in India is growing with the increase in income and growing awareness of health and hygiene. COVID-19 has been a catalyst for attitudinal transformation towards healthcare. More and more people are able to afford quality healthcare facilities. More people are getting covered under health insurance, spending more on fitness and nutrition, and medical checkups. Although the pandemic has caused huge disruptions in the supply chain and a decrease in non-COVID-19 illness treatments, the healthcare industry was expected to make both short-term and long- term gains on account of the huge demand for antibiotics, nutrition supplements, and vaccines. On the technology front, there has been a large-scale adoption of AI for providing remote consulting and home health care. There has been a huge increase in the use of home diagnostic equipment.

Methodology

The study has adopted event study methodology to assess the performance of health care industry by assessing the stock market movement during the pandemic. The major focus of the study is to estimate the abnormal return (AR) associated with the pandemic. The inference regarding the AR accrued during the event is valid if the following three assumptions of the event study are fulfilled [24,29].

- The market should be efficient, meaning stock prices reflect all available information.

- The event is unanticipated- there should not be any precedent or prior information.

- The event window should be free from confounding effects which means there are no overlapping events that impact the valuation of firms during the period of study.

All these assumptions are satisfactorily fulfilled, as the Indian stock market is efficient and the pandemic was unanticipated and was the single most important event during the period of study. The event study has been conducted involving the following steps:

Identification of event and event date

: Event date is the date on which an important announcement is made which creates significant impact on the valuation of firms. The pandemic has travelled through various phases across the globe and had its impact in one form or other on the performance of firms. The intensity and timing of the impact have been varied across the countries. We have identified the following important events during the pandemic which is supposed to have significant impact on the performance of stocks of healthcare industry.

COVID-19 chronology of events in India:

- The 1st case in India 30th January, 2020

- The WHO declared it as pandemic on 11th March, 2020.

- 1st casualty in India on 12th March, 2020.

- 1st phase lockdown was declared on 24th March 2020 with effect from 25th March to 14th April, 2020.

- 2nd Phase of lockdown- 15th April to 3rd May, 2020.

- 3rd phase of lockdown- 4th May to 17th May, 2020.

- 4th phase of lockdown- 18th May to 31st May, 2020.

On assessment of all these events with respect to their overall impact, it was found that the announcement of the 1st pan- India lockdown, which happened on 24th March, 2020 is the most significant event. Since the announcement was done at 8 p.m. on 24th March, 2020 the effect on stock market happened on 25th March, 2020. This date has been considered as the event date for this study. Any event that has a big impact on stock market has to have a surprise element attached to it. Lockdown was very surprising in the sense that there was no precedence of country-wide lockdown in the last century. Though lockdown was happening in other countries, there was no concrete information available on the exact date of its implementation in India. The impact of lockdown could not be properly assessed on the date of declaration as there was no clarity on its implementation.

Determination of event window

Event window (EW) is the timeframe surrounding the event that is likely to have a substantial impact on the stock market. A long event window is detrimental to the power of test statistics and results in wrong inferences regarding the significance of an event [12,28-29]. Short-horizon event studies are a very powerful subject to careful selection of EW [29]. Researchers have used 10 days and 5 days EW preceding and succeeding the event [30, 31]. For this study, we have taken an EW of 21 days; 10 days before and 10 days after the event date of 25th March 2020. The EW duration has been kept reasonably short to avoid confounding event and, at the same time, kept reasonably long to allow the impact to reflect fully on the market as COVID-19 was evolving continuously.

Selection of sample

We have collected data of firms covering all segments of the healthcare ecosystem. Firms have been selected on the basis of market capitalization, as the impact will be well captured for larger firms. The samples have been selected from three segments of the healthcare industry, namely hospitals, pharmaceutical manufacturers, and diagnostic laboratories. We have selected fifteen pharmaceutical firms, four hospitals, and three diagnostic labs listed in National Stock Exchange (NSE) and Bombay Stock Exchange (BSE) for the study. Other players like medical equipment and supplies, medical insurance, and telemedicine have not been included as exclusive listed firms dealing with these segments were not available for study. For example, general insurance companies provide not only health insurance, but also other types of insurance like motor vehicles, livestock, industrial and commercial, crop insurance, etc. Therefore, it will be difficult to evaluate the impact of the pandemic on firms which have multiple product lines, including healthcare.

Selection of estimation window

Estimation window is the period excluding the EW, which is taken to calculate the normal return or expected return. This is the period during which the impact of the event is assumed to be zero. Expected return is the benchmark return that could have been obtained had there been no event. Researchers have used a minimum 120 to 255 business days’ data to conduct the event study [31]. We have collected daily stock return data for the selected healthcare stocks for 163 trading days from 1st June 2019 to 29th January, 2020. We have chosen 29th January, 2020 as the last date of our estimation window as the first COVID-19 case was found in India on 30th January, 2020. As China was struggling to deal with the menace of COVID-19 and the disease was spreading fast to other regions, the detection of the first case was an ominous signal to the stock market. Hence, the stock prices might have been impacted by the international events. Therefore, the estimation window has been kept clearly distinct to obviate any impact of the event on the stock price or any error in the computation of normal return. The estimation window ends before 28 trading days from the beginning of the event window.

Estimation of normal return

Normal return (NR) is the expected return (ER) during the event window if the event would not have happened. This is required to compute the abnormal return (AR). AR is calculated by deducting ER from the actual return. NR is calculated from the stock market data of estimation period using various models. These models have been categorized into two segments: statistical and economic [28]. The first category is based on statistical assumptions and focuses on asset returns. The second category is based on assumptions relating to investors’ behaviour. We have discussed the four most popular models below. Other statistical multi-index models (except for the Fama & French model) which take into account industry indexes along with market indexes, are not discussed, as the benefit of these models is limited and does not change the result significantly. Economic model like Capital Asset Pricing Models (CAPM) is no longer popular because of its inadequacy in explaining the patterns of average stock returns, and Arbitrage Pricing Theory (APT) does not have any significant advantage over the market model.

Constant mean return model: Being the simplest among all models, it uses the mean return of a particular stock during the estimation window to calculate ER. Then the ER is deducted from the actual returns in the event window to arrive at the AR. It was found to be equally efficient as other sophisticated models [11,12].

Market adjusted returns: The market return for the estimation period is considered as the ER. The gap between the actual return of the stock and the market return is the AR. This is known as a restricted market model as it assumes αi = 0 and βi = 1 [15].

Market Model or Risk Adjusted Returns Model: This is considered to be a better model as it attempts to reduce the variance of AR by eliminating the chunk of return that is caused by fluctuation in the market’s return.

This paper used the market model to estimate the normal return, as it is suggested to be the most appropriate model for a wide variety of situations [11]. It is recommended as the most simple and efficient among the three models [32]. This model correlates the security return with the market return. The stock return is regressed against the benchmark market index throughout the entire estimation period to get αi and βi. The αi (intercepts) and βi (slope coefficients) are calculated using ordinary least squares (OLS) regression of Rit on Rmt for the estimation period, and then the expected return is calculated using the following equation:

Where,

Rit= The stock return of firm i on day t

Rmt= the market return on day t

αi= The intercept (it is the part of security return that is independent of market performance)

βi= The systematic risk of stock i (sensitivity of stock return to market return)

Ɛit= The error term (the unexplained portion of the stock return which is caused by firm specific factors which is not reflected in market return. It is the unsystematic risk associated with the stock).

Fama-French three- factor model: This model is an improvement on the CAPM model of Sharpe and Lintner. It takes into account three factors: (i) Market risk, (ii) market capitalization, and (iii) book value to market value ratio to explain the ER. It suggests that small-cap companies outperform large-cap companies with respect to return. Similarly, firms with a high book-to-market ratio do better than those with a low ratio. The ER of a portfolio is determined by responsiveness of its return to three factors: (i) The gap between the risk-free rate and market return, (ii) the gap between return on a portfolio of small and large stocks, and (iii) the gap between return on a portfolio of high book value to market value and low book value to market value. This could be written as Expected return = Risk free rate + Market Risk premium + SMB + HML. The expected return is calculated using the following equation:

Where,

E(Ri)= Expected return of stock i

Rf = Risk free rate

Rm= Market return

β= Factor’s coefficient (sensitivity)

Rm – Rf = Risk premium

SMB (Small Minus Big)= Past data of excess return of firms in small cap category over firms in large cap category.

HML( High Minus Low)= Past data of excess return of value stocks (high book to market value) over growth stocks (low book to market value)

Ɛ= Random error

Computation of Abnormal return/ Cumulative abnormal return: The AR for the firm i and day t is calculated using the following mathematical equation.

After calculating the AR of an individual stock for a particular date in the event period, we need to calculate the aggregate abnormal returns for the total event period for a sample stock. The aggregate abnormal return across the time series is known as cumulative abnormal return (CAR). The time series aggregation is done using the following equation:

Once the time series aggregation is complete the cross-sectional aggregation has to be done across all the sample stocks to arrive at the average abnormal returns (AAR). AAR is the average return of all the sample stocks for a given day in the event window. AAR for N number of stocks for t day is calculated using the following equation:

Then, the AAR of each day of the event period is aggregated to get the cumulative average abnormal return (CAAR). The CAAR is calculated using the following mathematical equation:

Test the abnormal returns for significance: After obtaining all the above parameters, the significance test has been conducted to test the hypothesis which is whether the abnormal return is statistically different from zero.

Data collection

Stock return data has been collected for 22 firms belonging to the health care ecosystem listed on the National Stock Exchange (NSE) for the estimation window ranging from 1st June 2020 to 29th January 2020 and for the event window from 11th March 2020 to 13th April 2020. There are a total of 163 trading days in the estimation window and 21 trading days in the EW. The index returns of CNX Nifty index (50 largest Indian companies listed in the NSE), Nifty Pharma (10 large pharmaceutical companies), and BSE Healthcare (95 stocks belonging to all healthcare segments) have been collected for the same period. The stock return has been calculated on the basis of the closing price of each day in both the estimation and the event window. The return is either positive or negative depending upon the closing price of t day compared with t-1 day. The data has been collected from the following online sources.

https://in.investing.com/equities/

https://www.moneycontrol.com/stocks

Data analysis

We have calculated the CAAR by using the event study command in STATA statistical software. As mentioned in methodology section, we have used the market model (single index model) and the Fama & French three-factor model (multi-index model) to calculate the normal return. The expected or normal return has been calculated using the data for the period of 1st June, 2019 to 29th January, 2020 (estimation window). The logic and context for the selection of the estimation window have already been mentioned in methodology section. After estimating the normal return, the gap between the normal return and the actual return in the event period (11th March, 2020 to 13th April 2020) is computed to obtain the abnormal return, and then the ARs have been aggregated across the event window and across sample stocks (time series aggregation and cross-section aggregation) to calculate CAAR. The CAAR of each stock and the portfolio CAAR is mentioned in Tables 2 and 3. Finally, the CAAR has been used to test the hypothesis, i.e. if the abnormal return is not equal to zero and statistically significant.

Results and Discussion

The results reveal that out of 15 pharmaceutical company stocks, 13 have positive CAAR and two have negative CAAR. Out of 13 stocks that have positive CAAR, the CAAR of 13 stocks is statistically significant. The results clearly indicate that the stocks of pharmaceutical companies have been positively impacted by the pandemic. The result confirms the assumption that as the demand for drugs increased many fold during the pandemic, pharmaceutical companies were expected to have higher income, which was reflected in their stock price. As shown in table 3 the pharmaceuticals portfolio CAAR was 19.72% (Market model) and 18.75% (Fama & French three-factor model) which is statistically significant. This further confirms the positive impact of the pandemic on the pharmaceutical companies’ stock returns. The result of this study is supported by past research done by [22,23,27]. The results of both models show a similar trend.

Out of 4 hospital stocks, all four have negative CAAR, and the abnormal return for one hospital is statistically significant. The results confirm that hospital stocks have been negatively impacted by the pandemic. It implies that the operations of hospitals were disrupted by the outbreak of COVID-19. General patients did not go to hospitals fearing the spread of the virus, and doctors and paramedical staff were also not regularly attending hospitals. Therefore, in the 1st phase of lockdown, the hospitals were expected to incur losses and the same was reflected in their stock price. The portfolio abnormal return (CAAR) of the hospital stocks as shown in table 3 is negative 13.98% (Market model) and negative 10.89% (Fama & French three-factor model) and is statistically significant.

With respect to healthcare companies engaged in diagnostics and laboratories, as shown by the market model, 2 stocks have a negative CAAR and 1 stock has a positive CAAR and the CAAR of 1 stock is statistically significant. But as per the Fama & French model, the CAAR of two stocks is positive, and one stock is negative and the CAAR of no stock is statistically significant. The difference in results between two models is attributed to the SMB and HML factors taken into consideration for computing the abnormal return by the Fama & French model. As there is no separate SMB and HML factor data available for diagnostic stocks in India, the result is different for the model. The other reason could be the availability of small sample (only three stocks) for the study of the diagnostic segment. Hence, for this segment, the market model would be the appropriate one. As per the market model, the results confirm the assumption that the diagnostic segment was expected to suffer on account of lockdown and this has been reflected in their stock return.

Econometric Issues

Having completed the parametric t test, we need to understand the econometric issues with the event study model and adopt alternative tests to validate the result. Event study models suffer from autocorrelation for both time series data and cross-sectional data. It means the ARs are not independent and not random across the event period and also across the firms. Besides that, the ARs have different variances across firms (hetroscedasticity) and have greater variance during the event period than that of the surrounding periods. The issues of hetroscedasticity and cross-sectional dependence in event studies were highlighted by [33,34]. It was confirmed that the abnormal returns differ across firms, and contemporaneous correlation among abnormal returns was also found across firms in the market model [32-36]. Concerns were expressed over cross-sectional dependency, which could result in underestimation of variances and rejection of the null hypothesis [12]. On evaluation of the impact of cross correlation and hetroscedasticity in the event study, it was found that the results are substantially biased if these issues are not rectified [37,38].

Event study models are based on the assumption that there is no cross-sectional correlation among ARs. This condition is violated when the event day is common across the firms and the firms are chosen from a particular industry. In this paper the event date is common and the firms are also chosen from a particular industry. Though the market model reduces the cross-correlations of residuals (abnormal returns) to a large extent, total elimination of the impact of cross-correlation may not be possible [11,12]. Therefore, application of the model might lead to underestimation of standard error and in turn results in over rejection of the null hypothesis that abnormal return equals to zero. The portfolio method of Jaffe, in which portfolio returns and portfolio abnormal returns are studied, solves the contemporaneous correlation problem to a large extent [33].

The standard t-test is the ancestor of all parametric tests, and researchers have improved it to remove prediction errors. A model based on standardised abnormal returns was designed to overcome the shortcomings of standard t-test [38]. It was further improved to address the problem of event-induced volatility [39]. But still, the cross-sectional correlation issue remained unresolved. In order to resolve the cross-sectional correlation, Kollari and Pynonnen [40] modified the BMP test [39].

A non-parametric rank test was introduced, which was further modified by [41] in event study analysis for assessing abnormal returns [42]. The test had limited application only for assessing a single-day abnormal return. Generalized rank tests GRANK-Z and GRANK-T were designed to evaluate abnormal returns of multiple days [43]. Nonparametric tests were found to yield better results and are more powerful than their parametric counterparts [43]. It was concluded that the GRANK test was immune to serial correlation and event-induced volatility. It also resolves the issue of cross-correlation to a large extent. Non-parametric test is not based on the assumption of a normal distribution. It is in a way agnostic to distribution properties. Keeping in view the advantages of the non-parametric test, we have conducted the non-parametric rank test proposed by Kolari and Pynnonen [43]. The result of the test found to be exactly similar to the standard t-test. The diagnostic test confirms that the model chosen in the study is well specified and appropriate for the data set. Table-4 shows the CAAR of two healthcare indices (Nifty Pharma and BSE Healthcare). Out of the three health care indices, the data for Nifty Healthcare is not available for our study period. The CAAR for Nifty Pharma is 25.31, and the p value is 0.0000. Since the p-value is less than 0.05, it is statistically significant. The CAAR for BSE Healthcare is 17.16, and the p value is 0.0000, which is also significant. Taking into consideration the results of all the tests, the null hypothesis is rejected. The overall results confirm that the healthcare industry has been impacted by the pandemic. The findings of our study have been corroborated by the research result of [22,23,6,27]. The objective of impact assessment at the individual firm level is to validate the assumption that firms engaged in manufacturing drugs that were used in treating respiratory infections and COVID-19 were likely to gain most. This assumption was found to be correct, as evident from the result.

Limitation of the study and Scope of further research

COVID-19 is a worldwide event which spread over approximately one and half year and the peak contagion happened in different countries in different time. Therefore, the choice of event window was difficult as the information leakage and impact of the confounding event would impact the result of the study. Even though the pandemic evolved over time, it lost its surprising effect gradually. A comprehensive study including all important events during COVID-19 would enable us to determine the most important event that has impacted the healthcare industry during the pandemic. Individual firm-level impact assessments should be further widened to understand the firm-specific strengths and weaknesses with respect to the pandemic scenario. For example, firms that were engaged in research, development and manufacturing of vaccines should be making the maximum gains on the stock market. The scope of research should be widened to include other healthcare players like medical devices and equipment, medical insurance, and home healthcare including telemedicine, which were also assumed to have gained during the period. We could not include the segment in our study as we did not find enough firms in these segments listed in stock exchange.

Conclusion

The pandemic has increased the health awareness of the world population. It has severely impacted many countries reported to have developed healthcare infrastructure and high per capita healthcare spending. It has revealed the vulnerability of human beings to such an epidemic and emphasised expanding the healthcare infrastructure and increasing private spending on health, aiming at enhancing immunity. This will have a natural impact on the revenue and profit of firms engaged in health care. This paper examined the effect of the pandemic on the Indian healthcare industry and found that the sector has been positively impacted. The findings of the research are in line with the general assumption that the healthcare industry should benefit from the pandemic. While the pharmaceutical companies were found to have been positively impacted, the hospitals have been negatively impacted and the diagnostic sector showed mixed results. The study will help researchers and investors understand the impact of such macro-event on the health care industry. The article adds to the event study literature involving events having international ramifications and long-term impacts.

Acknowledgements

The authors acknowledge the support and guidance received from the staff of the administrative wing and library of KIIT School of Management.

ORCID

Ashok Kumar Sar: https://www.orcid.org/0000-0002-7861-9060

Kshirod Kumar Panigrahi*: https://www.orcid.org/0009-0001-9526-3932

-------------------------------------------------------------------------------------------

How to cite this article: Ashok Kumar Sar, Kshirod Kumar Panigrahi *, Impact of pandemic on health care ecosystem - A study of indian health care industry. Journal of Medicinal and Pharmaceutical Chemistry Research, 2024, 6(5), 519-536. Link: http://jmpcr.samipubco.com/article_186619.html

-------------------------------------------------------------------------------------------

Copyright © 2024 by SPC (Sami Publishing Company) + is an open access article distributed under the Creative Commons Attribution License(CC BY) license (https://creativecommons.org/licenses/by/4.0/), which permits unrestricted use, distribution, and reproduction in any medium, provided the original work is properly cited.

.png)

.png)

.png)

.png)

.png)

.png)

.png)